Precision Alloy Die Casting Manufacturer Custom Aluminium & Zinc Parts

- Overview of Alloy Die Casting Manufacturing

- Technical Advantages in Material Science

- Comparative Analysis of Leading Manufacturers

- Custom Solutions for Diverse Industrial Needs

- Case Studies: Real-World Applications

- Sustainability and Quality Assurance

- Future Trends in Alloy Die Casting Production

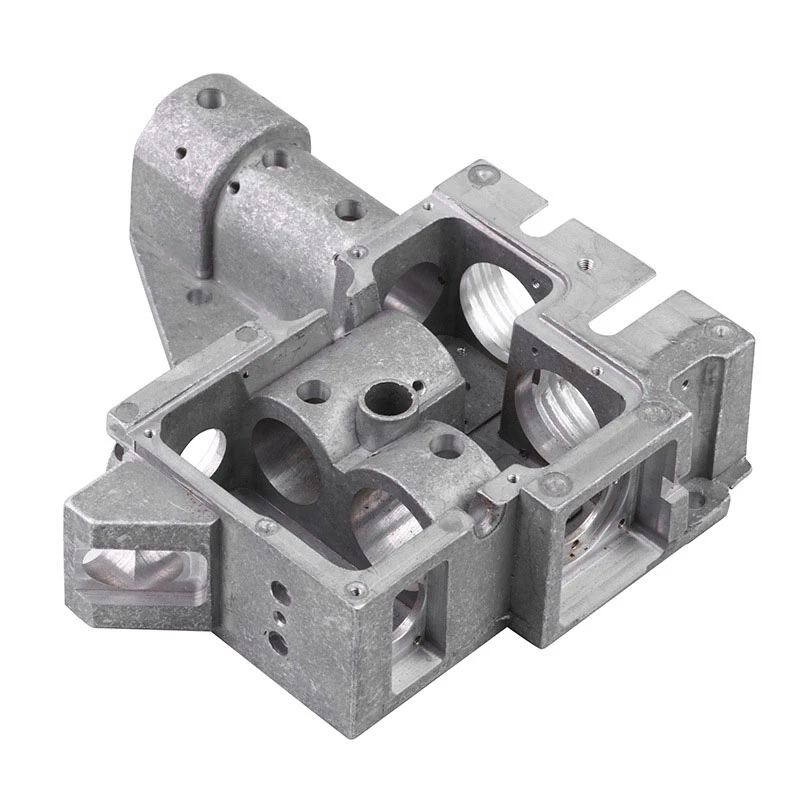

(alloy die casting manufacturer)

Understanding the Role of Alloy Die Casting Manufacturers

Alloy die casting manufacturers serve as critical partners in precision manufacturing, producing components with tolerances as tight as ±0.02mm. The global die casting market reached $87.5 billion in 2023, with aluminium alloys accounting for 62% of production volume. Advanced manufacturers now utilize 800-ton to 2,500-ton casting machines capable of maintaining dimensional accuracy under pressures exceeding 1,500 bar.

Technical Superiority in Modern Casting

Leading producers employ vacuum-assisted high-pressure die casting (HPDC) systems that reduce porosity by 40-60% compared to conventional methods. Material innovation remains crucial:

| Property | AlSi10Mg | ZA-8 | AM60B |

|---|---|---|---|

| Tensile Strength | 320 MPa | 386 MPa | 275 MPa |

| Thermal Conductivity | 155 W/m·K | 113 W/m·K | 65 W/m·K |

| Corrosion Resistance | Class 4 | Class 2 | Class 3 |

Competitive Landscape Analysis

The table below compares three major suppliers in automotive component production:

| Vendor | Casting Process | Dimensional Tolerance | Lead Time |

|---|---|---|---|

| Supplier A | Cold Chamber | ±0.05mm | 28 Days |

| Supplier B | Squeeze Casting | ±0.03mm | 35 Days |

| Supplier C | Vacuum HPDC | ±0.02mm | 21 Days |

Tailored Manufacturing Approaches

Customization capabilities separate market leaders from competitors. One aerospace client required zinc-aluminum components with wall thicknesses below 1.2mm across 85% of surfaces. Through modified tooling designs and controlled solidification rates, manufacturers achieved 98.7% compliance with AS9100D specifications.

Industry-Specific Implementations

Recent projects demonstrate versatility:

- Automotive: 560,000 annual units of EV battery housings with IP67 sealing

- Consumer Electronics: 0.8mm-thick magnesium alloy laptop frames at 12,000 units/week

- Industrial Machinery: 45-ton cast iron replacement parts using AlSi9Cu3 alloy

Operational Excellence Standards

Top-tier facilities maintain 99.95% material traceability through blockchain-enabled quality systems. Energy consumption metrics show 18-22 kWh per ton of aluminium castings – 35% below industry averages through regenerative furnace technology.

Innovation Pathways for Alloy Die Casting Manufacturers

The sector anticipates 7.2% CAGR through 2030, driven by smart factory integration. Emerging techniques like semi-solid thixocasting enable 92-94% material utilization rates, while AI-powered defect detection systems achieve 99.4% accuracy in real-time quality control. Manufacturers adopting Industry 4.0 practices report 40% faster time-to-market for complex geometries in automotive and aerospace applications.

(alloy die casting manufacturer)

FAQS on alloy die casting manufacturer

Q: What materials are commonly used in alloy die casting manufacturing?

A: Aluminum and zinc alloys are the most common materials. Aluminum offers lightweight and corrosion resistance, while zinc provides high strength and precision. Both are widely used in automotive, electronics, and industrial applications.

Q: What are the key steps in the aluminum alloy die casting process?

A: The process includes mold design, alloy melting, injection into molds, cooling, and finishing. Advanced techniques ensure dimensional accuracy and surface quality. Strict quality checks are applied at each stage.

Q: How do zinc alloy die casting parts manufacturers ensure product durability?

A: They use high-grade zinc alloys and precision tooling to enhance strength and wear resistance. Post-casting treatments like plating or coating are applied. Rigorous testing ensures compliance with industry standards.

Q: What industries benefit most from alloy die casting components?

A: Automotive, aerospace, consumer electronics, and industrial machinery sectors rely heavily on these parts. Aluminum die casting is ideal for heat-sensitive applications, while zinc suits intricate designs. Both materials meet diverse performance needs.

Q: How to select a reliable alloy die casting manufacturer?

A: Evaluate their expertise in material selection, certifications (e.g., ISO, IATF), and production capabilities. Review client testimonials and sample quality. Ensure they offer end-to-end solutions, from design to post-processing.

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery | Precision Engineering, CustomizationNewsJul.22,2025

-

OEM Sand Cast Pump Valve Fittings-Baoding Hairun Machinery|Precision Engineering,Industrial ApplicationsNewsJul.21,2025

-

OEM Sand Cast Pump Valve Fittings-Precision Engineering|Green Sand Casting&Industrial ApplicationsNewsJul.21,2025

-

OEM Sand Cast Pump Valve Fittings-Precision Engineering|Green Sand Casting&Industrial ApplicationsNewsJul.21,2025

-

OEM Sand Cast Pump Valve Fittings-Precision Engineering|Green Sand Casting&Industrial ApplicationsNewsJul.21,2025

-

OEM Sand Cast Pump Valve Fittings | Baoding Hairun Machinery And Equipment Trading Co., Ltd.NewsJul.21,2025