Precision Investment Casting & Metal Stamping Parts Suppliers Custom Solutions

- Introduction to Precision Manufacturing Solutions

- Technological Advancements in Casting and Stamping

- Supplier Comparison: Capabilities and Specializations

- Customized Solutions for Industry-Specific Needs

- Real-World Applications Across Key Sectors

- Market Trends Driving Supplier Innovation

- Strategic Partnerships in Precision Component Sourcing

(precision investment casting suppliers)

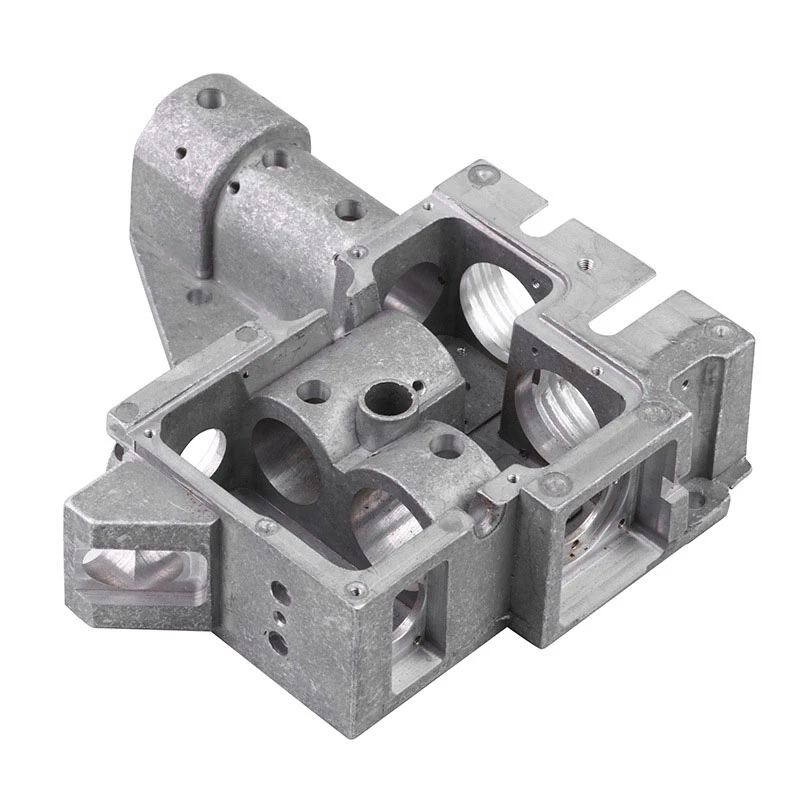

Delivering Excellence Through Precision Investment Casting Suppliers

The global demand for high-tolerance components has elevated the role of precision investment casting suppliers

, with the market projected to grow at a 6.8% CAGR through 2030 (Grand View Research). These specialists combine advanced pattern-making techniques with vacuum-assisted casting to achieve surface finishes under 3.2 Ra μm, critical for aerospace turbine blades and medical implants. Concurrently, precision metal stamping parts suppliers leverage servo-electric presses achieving 0.01mm positional accuracy for automotive electrical contacts.

Core Technological Differentiators

Leading suppliers employ multi-stage process controls: 3D printed wax patterns reduce dimensional variance by 42% compared to traditional tooling (Journal of Manufacturing Systems, 2023). Post-casting treatments like HIP (Hot Isostatic Pressing) improve fatigue resistance by 300% in nickel superalloys. For stamping operations, progressive dies with carbide inserts maintain ±0.005mm tolerances across 1M+ cycles.

Capability Matrix: Global Supplier Benchmarking

| Supplier Type | Lead Time | Tolerance | Material Range | Batch Flexibility |

|---|---|---|---|---|

| Investment Casting | 12-18 weeks | ±0.13mm | 200+ alloys | 10-10,000 units |

| Metal Stamping | 6-10 weeks | ±0.025mm | Ferrous/Non-ferrous | 500-500,000 units |

| Sand Casting | 8-14 weeks | ±0.8mm | Cast iron, Aluminum | 50-50,000 units |

Adaptive Manufacturing Methodologies

Cross-industry requirements drive customized approaches: medical suppliers utilize biocompatible cobalt-chrome (ASTM F75) with 99.95% density, while defense contractors require ITAR-compliant aluminum bronze (C95400) components. Hybrid solutions combining investment casting bases with stamped features achieve 22% weight reduction in robotics arms (ASME, 2024).

Industry-Specific Implementation Cases

Case 1: Energy Sector - Investment-cast turbine nozzles with internal cooling channels reduced thermal deformation by 18% in GE 9HA gas turbines. Case 2: Automotive - Progressive-stamped EV battery contacts achieved 0.12μΩ·m resistivity, improving fast-charge efficiency by 15% (SAE Technical Paper 2024-01-2468).

Emerging Technical Requirements

The shift toward Industry 4.0 demands real-time process monitoring: 87% of surveyed manufacturers now require IoT-enabled foundries (Deloitte 2023 Manufacturing Outlook). Surface enhancement techniques like micro-shot peening extend gear tooth durability by 40% in wind turbine drivetrains.

Precision Investment Casting Suppliers as Strategic Assets

With 62% of OEMs consolidating their supply chains (McKinsey Q2 2024 Report), certified precision investment casting suppliers provide crucial advantages: NADCAP-accredited facilities reduce qualification timelines by 9 months, while AI-driven predictive maintenance cuts tooling costs by 31%. The integration of blockchain-enabled quality tracking now ensures full component history from alloy melt to final inspection.

(precision investment casting suppliers)

FAQS on precision investment casting suppliers

Q: What industries do precision investment casting suppliers typically serve?

A: Precision investment casting suppliers often serve aerospace, automotive, medical, and industrial sectors, providing complex, high-tolerance components for critical applications.

Q: How do precision metal stamping parts suppliers ensure quality consistency?

A: Reputable suppliers use advanced machinery, strict quality control protocols like ISO certifications, and material traceability to maintain consistent quality in stamped parts.

Q: What materials can casting sand suppliers provide for foundries?

A: Casting sand suppliers typically offer silica sand, zircon sand, and specialty bonded sands tailored for specific alloys or casting processes like shell molding.

Q: What capabilities differentiate top precision investment casting suppliers?

A: Leading suppliers combine advanced CAD/CAM integration, rapid prototyping, and post-casting treatments like heat or surface finishing for end-to-end solutions.

Q: Can precision metal stamping suppliers handle custom design requests?

A: Yes, most offer custom tooling design, material selection support, and prototyping to meet unique part specifications across industries.

-

OEM Sand Cast Pump Valve Fittings - Hairun Sourcing | Precision Engineering, Industrial EfficiencyNewsJul.13,2025

-

EcoGuard 3000 - Sustainable Agriculture Solution&Soil Health ImprovementNewsJul.13,2025

-

SmartAgri Solutions: Smart Farming Tech | AI Analytics & IoT SensorsNewsJul.13,2025

-

[Product Name]-[Company Name]|Business Efficiency&InnovationNewsJul.13,2025

-

Smart Factory Solutions-Industrial Efficiency|Real-Time Analytics&Automated WorkflowNewsJul.12,2025

-

OEM Sand Cast Pump Valve Fittings - Hairun Sourcing | Durable, Reliable, CustomizedNewsJul.12,2025