Targeted Investment Strategies for Maximizing Returns and Minimizing Risks in Financial Markets

Precision Investment The Future of Smart Financial Growth

In the rapidly evolving world of finance, conventional investing methods often fall short of meeting the diverse needs of modern investors. Enter precision investment—a strategy that leverages data, technology, and advanced analytics to optimize investment choices with a level of accuracy previously unimaginable. With the rise of big data and machine learning, precision investment is not just a trend; it represents a fundamental shift in how we think about growing our wealth.

Understanding Precision Investment

Precision investment goes beyond standard investment practices by incorporating a personalized, data-driven approach tailored to individual investor profiles. This strategy applies sophisticated algorithms and predictive analytics to evaluate an array of factors, including market trends, economic indicators, and individual risk tolerance. The result? Tailored investment portfolios that are fine-tuned to maximize returns while minimizing risks.

For instance, traditional investment strategies often rely on historical performance and fixed asset allocations. In contrast, precision investment utilizes real-time data analysis to anticipate market movements and adjust allocations accordingly. By continually refining investment strategies based on current data, investors can remain agile in the face of volatility and changing market conditions.

The Role of Technology

Technology plays a pivotal role in the realm of precision investment. Financial technology (fintech) companies are at the forefront of this shift, deploying artificial intelligence (AI) and machine learning (ML) models to analyze vast datasets and extract actionable insights. These technologies can identify investment opportunities that might go unnoticed by human analysts, enabling investors to capitalize on emerging trends more quickly.

Moreover, robo-advisors—a prominent feature of the fintech landscape—are designed to provide automated, algorithm-driven financial planning services with minimal human intervention. They assess an individual's financial situation and goals, crafting a personalized investment strategy that adjusts with real-time market data. This not only democratizes access to sophisticated investment strategies but also lowers costs, making precision investment accessible to a broader audience.

Benefits of Precision Investment

precision investment

The primary advantage of precision investment lies in its capacity for customization. Investors can tailor their portfolios according to specific objectives, risk appetites, and time horizons. This personalized approach not only enhances the likelihood of achieving financial goals but also fosters greater investor confidence.

Moreover, the predictive capabilities of precision investment allow for timely reactions to market changes. Investors can quickly adjust their strategies in response to new information, be it economic data releases or geopolitical events, ultimately improving their performance and protecting their capital during downturns.

Another significant benefit is the reduction of emotional bias in investment decisions. Traditional investing often suffers from human error—fear and greed can lead to impulsive decisions that decimate portfolios. Precision investment, driven by data rather than emotion, helps mitigate these risks. Investors who rely on data analysis are less likely to fall prey to psychological pitfalls, resulting in more disciplined, objective decision-making.

Challenges and Considerations

Despite its many benefits, precision investment is not without its challenges. The reliance on technology necessitates robust cybersecurity measures to protect sensitive financial data. Additionally, the accuracy of predictive models is contingent upon the quality of data inputs; unreliable data can yield misleading results. As such, investors must be cautious and ensure they are utilizing reputable technology platforms.

Furthermore, while precision investment offers tailored strategies, it is essential for investors to remain engaged and informed. Continuous learning about market dynamics and the intricacies of their investment strategies can empower individuals to make more informed choices.

Conclusion

In conclusion, precision investment stands at the intersection of finance and technology, offering a groundbreaking approach to wealth management. By harnessing data analytics and machine learning, investors can navigate the complexities of the financial landscape with unprecedented accuracy and confidence. As this approach gains traction, it promises to redefine investing for a new generation, empowering individuals to take control of their financial futures. The era of precision investment is here, and it beckons all who seek smarter, more tailored pathways to financial growth.

-

Advanced Crawler Drilling Rig - Baoding Hairun Machinery | Underground Mining SolutionsNewsAug.14,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery And Equipment Trading Co., Ltd.NewsAug.14,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun | Customizable Fluid Control & Industrial Casting SolutionsNewsAug.14,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery And Equipment Trading Co., Ltd.|Precision Engineering, CustomizationNewsAug.14,2025

-

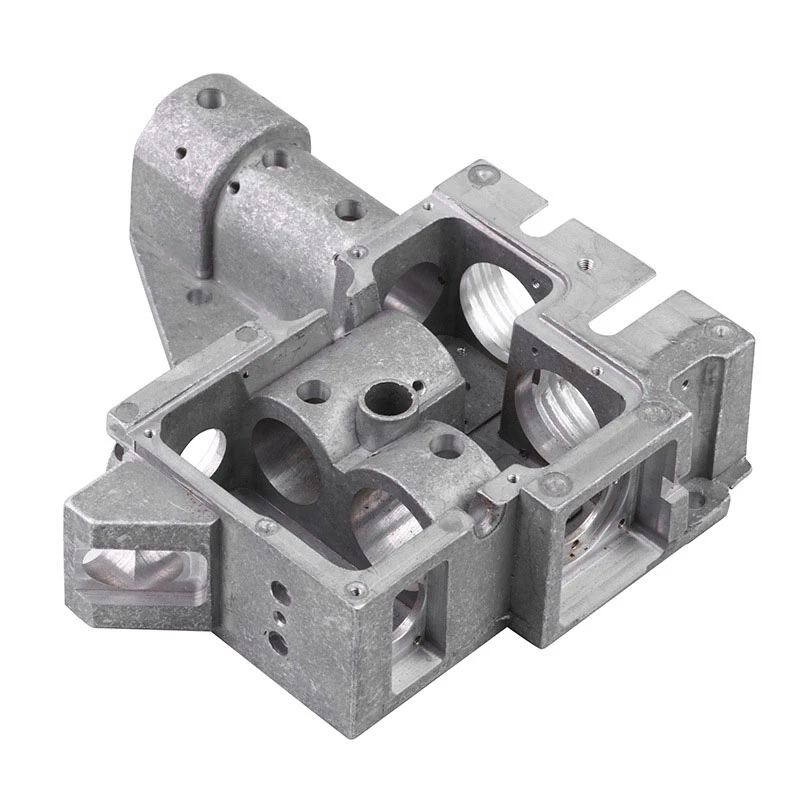

Precision Pressure Casting | Aluminum & Vacuum Die Casting ProductsNewsAug.14,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery | Customization, Quality AssuranceNewsAug.14,2025