Gen . 20, 2025 03:36

Back to list

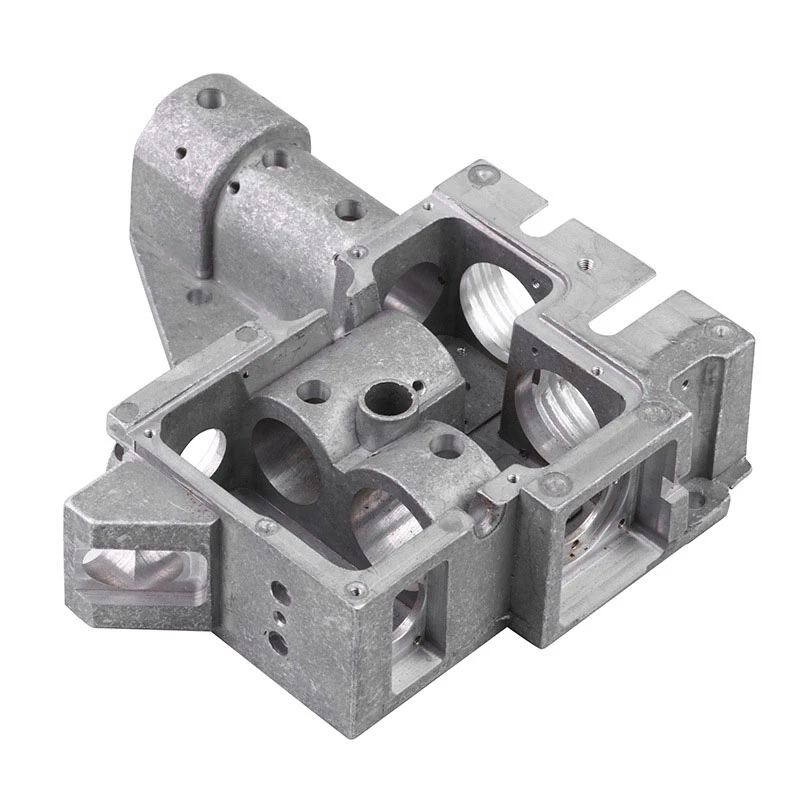

Oem Precision Castings Pressure Transmitter Platen

Precision investment has emerged as a groundbreaking approach in the financial landscape, redefining how investors allocate resources and manage risks. By leveraging cutting-edge technology and data analytics, precision investment allows for highly tailored and strategic portfolio management, minimizing uncertainty and maximizing returns. This method is becoming indispensable for both individual and institutional investors striving to maintain a competitive edge.

Furthermore, precision investment enhances decision-making through robust risk management frameworks. By employing sophisticated risk assessment tools, it identifies potential vulnerabilities within a portfolio and implements strategic adjustments to mitigate these risks. This proactive stance empowers investors to safeguard their assets and achieve long-term stability. The rising popularity of precision investment is underscored by its endorsement from financial experts and thought leaders. Many seasoned professionals acknowledge its transformative potential and advocate its integration into traditional investment practices. Financial advisors with extensive experience often highlight the enhanced predictability and control offered by precision investment, drawing attention to its alignment with modern investment demands. Trustworthiness is a pivotal pillar of precision investment. The transparency and accountability embedded within this approach foster investor confidence. Investors can trace the rationale behind each investment decision, ensuring clarity and understanding. Additionally, the utilization of AI-driven models undergoes regular audits and reviews, maintaining ethical standards and regulatory compliance. As precision investment continues to evolve, its implications on the product investment sector are profound. Products ranging from financial instruments to real assets can be efficiently managed through this strategy. Precision investment provides insights into optimal acquisition timings, market entry points, and portfolio diversification, enhancing product lifecycle management and ensuring sustained profitability. In conclusion, precision investment stands at the forefront of financial innovation, offering a sophisticated blend of technology and human expertise. Its focus on data-driven insights, real-time analytics, and customizable strategies makes it a preferred choice for discerning investors. As the financial ecosystem becomes increasingly complex, the precision investment approach equips investors with the tools necessary to navigate challenges and capitalize on opportunities, paving the way for sustainable financial growth.

Furthermore, precision investment enhances decision-making through robust risk management frameworks. By employing sophisticated risk assessment tools, it identifies potential vulnerabilities within a portfolio and implements strategic adjustments to mitigate these risks. This proactive stance empowers investors to safeguard their assets and achieve long-term stability. The rising popularity of precision investment is underscored by its endorsement from financial experts and thought leaders. Many seasoned professionals acknowledge its transformative potential and advocate its integration into traditional investment practices. Financial advisors with extensive experience often highlight the enhanced predictability and control offered by precision investment, drawing attention to its alignment with modern investment demands. Trustworthiness is a pivotal pillar of precision investment. The transparency and accountability embedded within this approach foster investor confidence. Investors can trace the rationale behind each investment decision, ensuring clarity and understanding. Additionally, the utilization of AI-driven models undergoes regular audits and reviews, maintaining ethical standards and regulatory compliance. As precision investment continues to evolve, its implications on the product investment sector are profound. Products ranging from financial instruments to real assets can be efficiently managed through this strategy. Precision investment provides insights into optimal acquisition timings, market entry points, and portfolio diversification, enhancing product lifecycle management and ensuring sustained profitability. In conclusion, precision investment stands at the forefront of financial innovation, offering a sophisticated blend of technology and human expertise. Its focus on data-driven insights, real-time analytics, and customizable strategies makes it a preferred choice for discerning investors. As the financial ecosystem becomes increasingly complex, the precision investment approach equips investors with the tools necessary to navigate challenges and capitalize on opportunities, paving the way for sustainable financial growth.

Latest news

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun | Precision Engineering, CustomizableNewsJul.30,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery And Equipment Trading Co., Ltd.NewsJul.30,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery And Equipment Trading Co., Ltd.NewsJul.30,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery|Precision Engineering&Fluid ControlNewsJul.30,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery And Equipment Trading Co., Ltd.NewsJul.30,2025

-

OEM Sand Cast Pump Valve Fittings-Baoding Hairun Machinery And Equipment Trading Co., Ltd.NewsJul.30,2025

PRODUCTS CATEGORIES