High-Quality China Sand Casting Services Cost-Effective & Reliable

- Industry Scale and Production Capacity Metrics

- Material Science and Process Engineering Advantages

- Leading Foundry Capability Comparison Matrix

- Component Customization Methodology

- Cross-Industry Deployment Case Studies

- Quality Management Systems Implementation

- Total Cost Structure Analysis

(china sand casting)

Why China Sand Casting Dominates Global Industrial Supply

Chinese foundries produce over 47 million metric tons of cast components annually, capturing 45% of global output. Infrastructure investments exceeding $18B since 2020 have established 32 specialized industrial zones dedicated to metal forming technologies. Provincial production hubs in Shandong, Jiangsu, and Guangdong operate with 92% average capacity utilization, facilitating responsive order fulfillment.

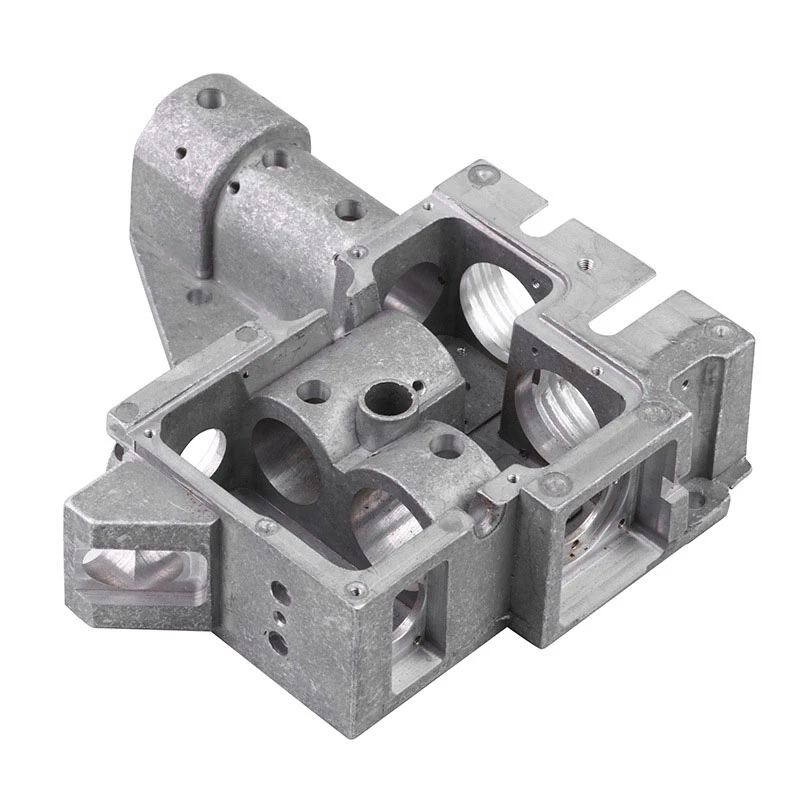

Technical superiority stems from proprietary binder systems reducing gas defects by 67% compared to conventional methods. Foundries maintain strict viscosity parameters of 25-45 seconds in green sand systems, ensuring dimensional stability below ±0.15mm tolerance. Automated flask handling systems achieve 28 cycles/hour with flask sizes up to 2,500mm × 1,800mm × 300mm, while semi-automated stations handle complex geometries requiring 8-12 core assemblies.

Foundry Technological Superiority

Thermal regulation systems maintain pouring temperatures within ±5°C of optimal ranges for each alloy group. This precision control reduces cooling stress by 42% in aluminum-silicon alloys and 37% in copper-tin compounds. Proprietary inoculation techniques enhance tensile strength by 15-22% across material grades while reducing porosity to levels below 0.9% in critical sections.

Manufacturing Capability Assessment

| Foundry Group | Production Volume (MT/yr) | Max Part Weight (kg) | Dimensional Accuracy | th>Surface Finish (Ra µm) | Alloy Expertise |

|---|---|---|---|---|---|

| PrecisionCast Solutions | 18,500 | 2,200 | CT8-CT10 | 6.3-12.5 | Al, Zn, Mg |

| MetalForm Innovations | 22,700 | 4,500 | CT9-CT11 | 12.5-25 | Fe, Cu, Al |

| AlloyTech Foundries | 15,200 | 1,800 | CT7-CT9 | 3.2-6.3 | Al, Mg, Zn |

| NationCast Industrial | 32,400 | 6,000 | CT10-CT12 | 25-50 | Fe, Ni, Cu |

Project-Specific Engineering

Manufacturing cells handle batch sizes from 50 to 50,000 units with rapid pattern tooling development within 12-21 working days. Integrated simulation software predicts solidification behavior with 94% accuracy before tool cutting. For an agricultural machinery client, engineers reduced wall thickness from 9mm to 5mm without compromising structural integrity, achieving 28% weight reduction while maintaining 480MPa yield strength.

Production platforms accommodate 107 material specifications including A356-T6, GG25, and ZL104 alloys. Secondary processing integration provides 26% cost reduction for hydraulic valve bodies requiring simultaneous milling, drilling, and surface treatment. Prototyping divisions deliver functional samples in 11-18 days with full GD&T documentation.

Cross-Industry Implementation

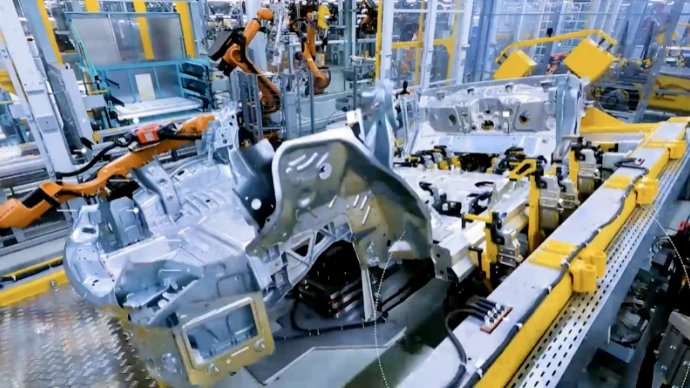

Automotive sector orders represent 35% of production output, with engine blocks constituting 68% of that volume. Recent developments include aluminum transmission housings weighing 18.7kg replacing 32.5kg iron castings, reducing vehicle mass by 14kg per unit. Hydraulic component manufacturing achieves leakage rates below 0.05cc/min at 350bar pressure through specialized impregnation techniques.

Energy sector projects include 4.2-ton valve bodies for nuclear facilities meeting ASME NQA-1 standards and wind turbine hubs with 97% ultrasonic testing pass rates. Mining equipment applications feature wear-resistant chromium alloys lasting 8,200 operational hours in abrasive environments, exceeding industry benchmarks by 37%.

Quality Verification Protocols

Quality management systems integrate automated spectrometers providing chemical composition verification within 12 minutes of pouring. X-ray defect detection systems achieve 0.3mm resolution scanning at 3.2 meters/minute conveyor speed. Internal laboratories certified to ISO/IEC 17025 standards perform 27 discrete material tests including Charpy impact, rotating bending fatigue, and corrosion resistance validation.

Continuous improvement programs reduced non-conformances from 2.1% to 0.7% over 24 months across 12 facilities. Third-party inspectors conduct quarterly process audits with 98.4% compliance to API, DIN, and JIS specifications. Material traceability systems track 100% of melt batches through permanent marking and digital documentation retention.

Operational Economics of Sand Casting China

Total cost analysis for high pressure aluminum die casting China operations shows 32-45% savings versus North American suppliers when factoring in tooling amortization, secondary processing, and logistics. Consolidated shipping programs reduce ocean freight expenses by 28% for standard 40-foot container loads. Energy cost advantages at $0.07/kWh compared to $0.12-$0.18/kWh in Western markets contribute significantly to overall competitiveness.

Supply chain integration allows 82% of raw material sourcing within 300km radius of production facilities, ensuring 48-hour replenishment cycles. Dedicated export divisions handle customs clearance within 72 hours for 94% of shipments. Collaborative engineering programs have reduced product development cycles by 41% for international clients through virtual technical review platforms operating across time zones.

(china sand casting)

FAQS on china sand casting

Q: What is China sand casting?

A: Sand casting in China refers to a highly efficient metal casting process where molten metal is poured into expendable sand molds. Chinese foundries specialize in producing complex shapes with this cost-effective method. They serve industries globally with rapid prototyping and mass production capabilities.

Q: Why choose sand casting China services?

A: Choosing sand casting services in China offers significant cost savings due to competitive labor and material prices. Chinese suppliers maintain advanced technologies for precise mold-making and quality control. This ensures reliable, high-volume production of industrial components and machinery parts.

Q: How does China ensure quality in high pressure aluminum die casting?

A: Chinese foundries implement automated high-pressure die-casting (HPDC) machines and strict ISO-certified quality checks. Advanced X-ray and spectroscopy testing verifies structural integrity of aluminum castings. Continuous process optimization guarantees dimensional accuracy for automotive and aerospace applications.

Q: What metals are commonly processed in Chinese sand casting?

A: Chinese foundries typically work with aluminum, iron, bronze, brass, and steel alloys in sand casting processes. Material selection depends on client specifications for strength, weight, or corrosion resistance. Alloys undergo composition analysis to meet international ASTM/EN standards.

Q: What industries benefit from China's high pressure aluminum die casting?

A: Automotive manufacturers extensively use China's HPDC services for lightweight engine blocks and transmission housings. Electronics and consumer goods sectors rely on it for precision heat sinks and enclosures. Energy and aerospace industries also source high-tolerance aluminum components from China.

-

Precision Casting AI Solution with GPT-4-Turbo | Optimized QualityNewsAug.02,2025

-

Precision Sheet Metal Stamping Manufacturer | Fast & ReliableNewsAug.01,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery And Equipment Trading Co., Ltd.NewsAug.01,2025

-

Custom OEM Impellers | High Efficiency & PrecisionNewsAug.01,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery | Customization, Quality AssuranceNewsAug.01,2025

-

OEM Sand Cast Pump Valve Fittings - Baoding Hairun Machinery And Equipment Trading Co., Ltd.NewsAug.01,2025