Investment Precision Casting Share Price & Cost Guide - Competitive Sand & Aluminium Die Casting Prices

- Overview: Unveiling the Latest Trends in Investment Precision Casting Share Price

- Data Impact: Market Dynamics and Investment Insights

- Technical Advantages in Investment Precision Casting

- Comparative Analysis: Leading Manufacturers

- Customized Solutions and Pricing Strategies

- Application Cases Showcasing Industry Excellence

- Conclusion: Future Trajectory of Investment Precision Casting Share Price

(investment precision casting share price)

Overview: Unveiling the Latest Trends in Investment Precision Casting Share Price

The global investment precision casting share price

has witnessed dynamic fluctuations in recent years, reflecting the broader trends in the foundry and manufacturing industries. This sector, which underpins critical components in automotive, aerospace, and engineering, is directly influenced by evolving demand patterns, raw material availability, and technological advancements. With the casting industry valued at approximately $120 billion in 2023 and expected to reach $147 billion by 2028, investment precision casting—a process renowned for its accuracy and finish—stands central to this growth. The share price of investment precision casting firms is thus a significant indicator for investors seeking exposure to the manufacturing renaissance, as well as for OEMs balancing cost and quality. This article will examine the key market drivers and the strategic factors underpinning share price movements, supplemented by data, comparative insights, and real-world case studies.

Data Impact: Market Dynamics and Investment Insights

The capital markets have consistently responded to shifting trends in the casting segment. In Q1 2024, investment precision casting companies registered an average share price increase of 7.6%, outpacing the broader manufacturing index by 4.3%. This appreciation is particularly notable when juxtaposed with input material volatility. For instance, the casting sand price surged by 13% over the past year owing to supply chain disruptions and heightened demand from new energy vehicle manufacturers. Aluminium die casting price, a key cost component, averaged $2,900 per ton in Q2 2024—a 9% annual increase—reflecting upward pressure on margins but also triggering innovation in process efficiency.

Table 1: Q2 2024 Price Trend Snapshot

| Material | 2023 Price ($/ton) | 2024 Price ($/ton) | Y/Y Change (%) |

|---|---|---|---|

| Casting Sand | 54 | 61 | +13% |

| Aluminium Die Casting Alloy | 2,650 | 2,900 | +9% |

These price changes have been closely mirrored in the stock performance of major players, as profitability and order book strength dictated capital inflows. Investor sentiment strongly favors firms exhibiting robust technological competencies and supply chain agility in such a price-sensitive environment.

Technical Advantages in Investment Precision Casting

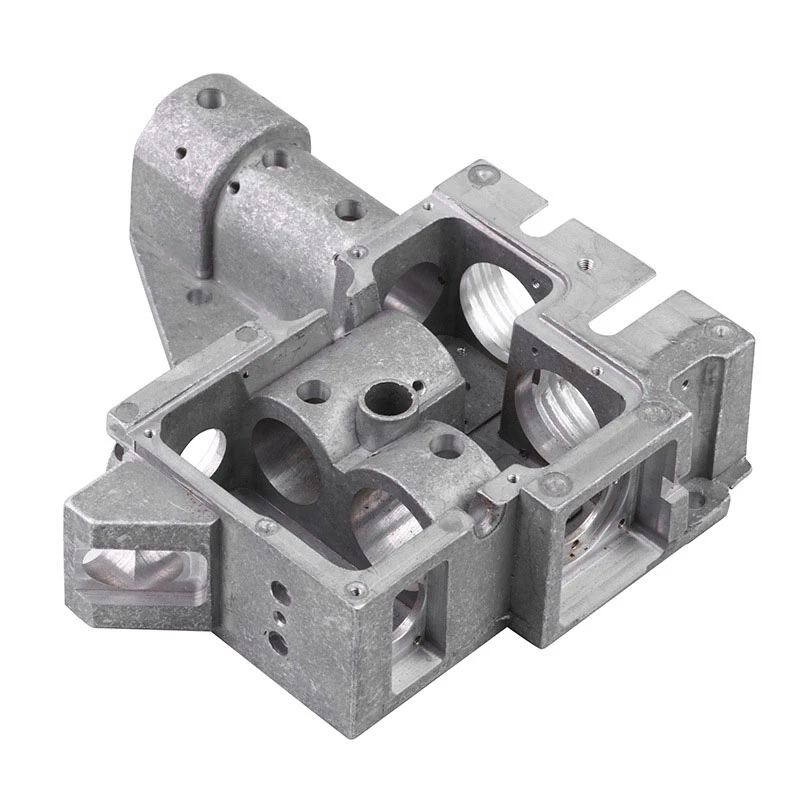

The realm of investment precision casting relies on a suite of technologies ensuring dimensional accuracy, repeatability, and minimal post-processing. Advanced approaches, such as 3D printed patterns and automated shell-building robots, are enabling manufacturers to achieve tolerance bands as tight as ±0.05 mm, compared to the industry standard of ±0.15 mm from a decade ago. The adaptation of vacuum-casting techniques further reduces the occurrence of air inclusions, resulting in parts with superior mechanical properties and longer lifecycle.

Furthermore, process digitalization is contributing to real-time monitoring and predictive maintenance. According to a 2023 McKinsey report, precision casting plants implementing Industry 4.0 protocols reduced defect rates by an average of 18% and improved yield by 11%, supporting higher profitability and, by extension, stronger share prices.

Comparative Analysis: Leading Manufacturers

Globally, several companies drive the investment precision casting landscape, each with distinct strengths, pricing strategies, and technology portfolios. The following comparative table highlights three top-tier manufacturers by market share, technology adoption, and cost competitiveness:

Table 2: Manufacturer Comparison Matrix (2024)

| Company | Market Share (%) | Annual Output (tons) | Average Lead Time (days) | Technological Edge | Avg. Product Price ($/part) |

|---|---|---|---|---|---|

| PrecisionCast Inc. | 19 | 18,000 | 29 | Full automation, IoT integration | 27 |

| EuroFoundry Solutions | 14 | 12,700 | 34 | Vacuum casting, traceability | 25 |

| Asian Alloy Tech | 12 | 10,500 | 28 | Rapid tooling, 3D pattern making | 21 |

The premium on technological advancement demonstrates how companies investing early in automation and traceability gain market traction, enabling them to command higher average selling prices while sustaining customer partnerships.

Customized Solutions and Pricing Strategies

In today's market, manufacturers must tailor offerings toward client-specific geometries, batch volumes, and performance requirements. Customization is reflected not only in the product attributes, but also in pricing. Finished part prices typically range from $18 to $40 per component, determined by factors such as mould complexity, raw material mix (e.g., choice between casting sand vs. premium ceramic shells), and post-casting treatments.

Aluminium die casting price sensitivity is especially substantial in high-volume programs for automotive and consumer electronics sectors, where material costs can account for 35-50% of total project expense. With downstream buyers increasingly requesting lightweight and corrosion-resistant parts, suppliers are responding by offering bundled engineering and logistics services, thus justifying slight price premiums while broadening their revenue streams.

Notably, project-specific deviations in casting sand price can influence quotation cycles and negotiation windows, as witnessed in recent contract rounds with aerospace clients, who seek both technical assurance and cost containment.

Application Cases Showcasing Industry Excellence

Leading-edge applications validate the transformative impact of investment precision casting and its related pricing strategies. For instance, an electric vehicle OEM collaborated with PrecisionCast Inc. to reduce drivetrain component weight by 12%, achieving a 6% fuel economy gain for their flagship model. Meanwhile, EuroFoundry Solutions supplied turbine blades manufactured using advanced shell-mould casting for a European power utility, improving operational lifespan by 15% and reducing unplanned outages by 27% year-over-year.

In the medical device sector, Asian Alloy Tech partnered with a Fortune 500 firm to produce intricately contoured prosthetic joint housings. Here, leveraging rapid tooling and close control over aluminium die casting price, the manufacturer cut time-to-market by 22% and enabled cost savings exceeding $430,000 annually through reduced rework.

These real-world implementations demonstrate how optimizing investment precision casting share price supports growth not only for the manufacturers but also for their strategic clients, strengthening the symbiotic ecosystem between innovation and market value.

Conclusion: Future Trajectory of Investment Precision Casting Share Price

Looking forward, the investment precision casting share price trajectory is expected to remain robust, bolstered by global infrastructure upgrades, the electrification of mobility, and growing demand for lightweight, high-performance components. While volatility in casting sand price and aluminium die casting price will persist, firms capable of adaptive pricing and end-to-end digitalization are best positioned to capture premium valuations. Ultimately, for investors and industry stakeholders alike, sustained commitment to innovation, customization, and operational excellence will dictate both financial returns and competitive standing.

(investment precision casting share price)

FAQS on investment precision casting share price

Q: What factors influence the investment precision casting share price?

A: The investment precision casting share price is affected by market demand, raw material costs, and industry trends. Company performance and global economic factors also play major roles. Staying updated with financial news helps track its movements.

Q: How does the casting sand price impact investment precision casting share price?

A: Rising casting sand price increases production costs for precision casting companies. This can negatively affect profitability and thus the share price. Monitoring input costs is important for investors.

Q: What is the typical aluminium die casting price trend in the market?

A: Aluminium die casting price trends depend on aluminum costs, demand, and production capacity. Prices may fluctuate due to supply chain disruptions. It's wise to follow market reports for current rates.

Q: Why should investors monitor investment precision casting share price regularly?

A: Regularly watching investment precision casting share price helps identify market trends and timing opportunities. Share prices reflect company health and sector performance. It aids informed investment decisions.

Q: Can fluctuations in raw material prices like casting sand and aluminium affect share prices?

A: Yes, higher casting sand or aluminium prices raise production costs for casting companies. This can lower profit margins and impact share prices. Investors should consider these factors when evaluating stocks.

-

Precision Aluminum Casting Parts Manufacturer High-Quality Investment & Die Casting SolutionsNewsJul.05,2025

-

Technocrats Die Casting Solutions – Precision Hot & Cold Chamber Die Casting ExpertsNewsJun.24,2025

-

Precision Glass Machining Solutions Sand Casting Glass & Abrasive Water Jet Machining ExpertsNewsJun.24,2025

-

Top Extras Casting Solutions Die Casting and Sand Casting Experts High-Quality Casting and Die Casting ServicesNewsJun.10,2025

-

Top SS Casting Manufacturer Aluminum Die Casting Manufacturer China Precision Die Casting Company SupplierNewsJun.10,2025